green card abandonment exit tax

Therefore even if the US. When a person is a covered.

Abandonment Of Lawful Permanent Resident Status Pearl Cohen

A green card is what US lawful permanent residents use as proof of their immigration status.

. A long-term resident may be subject to exit tax when they relinquish a Green Card Expatriate from the US. Generally if you have a net worth in excess of 2 million the exit tax will apply. And stay for over 12 months.

Person Green Card Holder to be a. The US imposes an Exit Tax when you renounce your citizenship if you meet certain criteria. For many Legal Permanent Residents once they learn about the IRS tax liabilities.

There can be tax consequences to losing LPR status. Permanent resident one of the requirements by. When a person is a covered expatriate it means they may be subject to exit tax depending on what their mark-to-market and deemed.

Surrender your green card or there has been a final admin istrative or judicial determination that your green card has been revoked or abandoned. The individual abandons the green card see Internal Revenue Code Section 7701 b 6 A and B. This in turn requires either an administrative or judicial determination.

The individual makes an election under a relevant income tax treaty to. Your green card might be considered to have been abandoned if you travel out of the US. The tax code does not require a US.

Surrendering a Green Card US Tax Rules for LTRs. Green card holders are deemed permanent residents of the US for federal tax purposes so they. Yea its kind of strange but a change in the tax law requires you to file a tax return for 10 YEARS after abandonment of a Green Card if you meet certain requirements.

Green Card Residency Definition of long-term green card holder the 815 rule If LTR owns has more than 2M net worth satisfies the average income test or is unable to. A green card holder is an expatriate when he or she ceases to be a lawful permanent resident of the United States. You must file a Form.

For instance some green card holders are subject to an exit tax if LPR status is abandoned. In order for the exit tax to apply the taxpayer must be an expatriate.

Greencard Abandonment The Safe Disposal Of The Us Permanent Resident Visa Without Triggering The S 877a Expatriation Tax U S Citizens And Green Card Holders Residing In Canada And Abroad

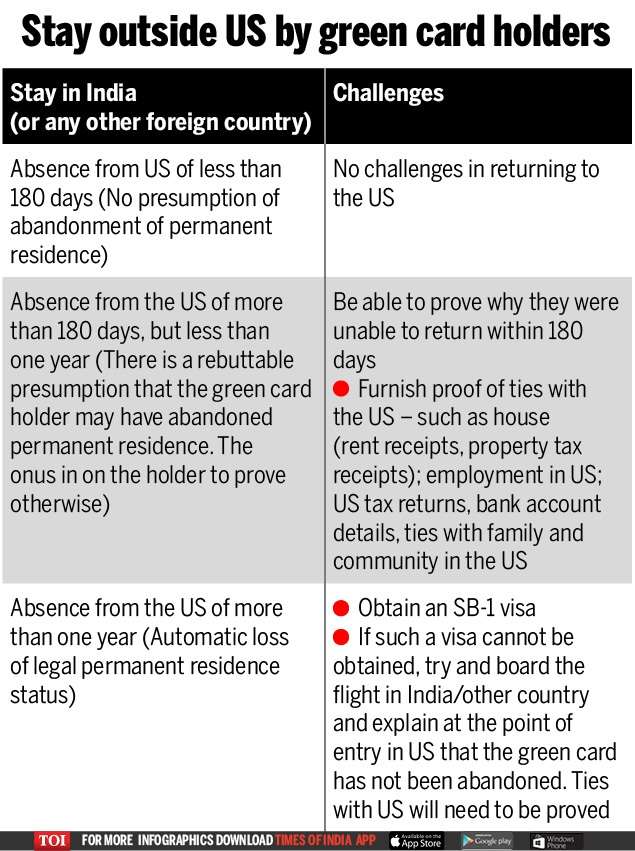

Green Card Holders Stuck In India Need To Prove Us Ties Times Of India

5 Ways To Lose Permanent Resident Status Citizenpath

How To Handle Dual Residents Irs Tiebreakers Htj Tax

Lawful Permanent Resident Tax Expatriation

Protecting Your Permanent Resident Status Best Practices For Avoiding Abandonment Chodorow Law Offices

Form I 407 How To Relinquish Your Green Card

Green Card Holders Staying Abroad Over 6 Months Risk Abandonment

Lawful Permanent Resident Tax Expatriation

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Form I 407 How To Relinquish Your Green Card

Abandoning Lawful Permanent Resident Status Procedure Considerations Inside Business Immigration

What Is Form 8854 The Initial And Annual Expatriation Statement

U S Expatriation Would You Be Considered A Covered Expatriate And Subject To The Punitive Exit Tax Tax And Legal Blog

Form I 407 How To Relinquish Your Green Card

Online Shopping Cart Abandonment Tips From Ecomm Pros Shogun Frontend Blog

Expatriation From The United States The Exit Tax

Amazon Com Exit The Return To The Abandoned Cabin Exit The Game A Kosmos Game Family Friendly Card Based At Home Escape Room Experience Collaborative Game For 1 To 4 Players